The New Rulers of the World (2001) by John Pilger provides a good example of a Dependency Theory analysis of the consequences of neoliberal globalisation, focusing on Indonesia as a case study.

The fact that this is a dependency view of development is quite clear from John Pilger’s own summary of the documentary:

“There’s no difference between the quite ruthless intervention of international capital into foreign markets these days than there was in the old days, when they were backed up by gunboats…. The world is divided between the rich, who get richer, and the poor, who get poorer, and the rich get richer on the backs of the poor. That division hasn’t changed for about 500 years” (the link above will take you to this quote)

Below I provide a brief summary of the documentary. The documentary is 15 years old now, but it provides a very useful introduction to the following concepts within global development.

- It provides an unambiguous example of a Dependency Theory analysis of underdevelopment in one country – Indonesia

- It’s an especially useful analysis of neo-colonialism – how economic institutions now work to extract wealth from a poor country.

- It introduces you to the role of the World Bank and the International Monetary Fund in an accessible way.

NB this documentary is now over 15 years old, so you might like to think about the extent to which it still applies to Indonesia 15 years on, and the extent to which you can generalise this analysis to other countries today.

(NB – the headings below are my own, not from the documentary)

John Pilger – The New Rulers of the World – intro section

In recent months, millions of people around the world have been protesting against a new economic order called globalisation.

Never before has the human race enjoyed such enormous capacity to create wealth and reduce poverty, but never before has inequality been so great.

A small group of individuals controls more wealth than the billion people in Africa, and just a handful of corporations dominate a quarter of the world’s economic activity – for example General Motors is now bigger than Denmark.

The famous brands of almost everything are now made in poor countries, with wages so low it borders on slave labour.

Tiger Woods is paid more money to promote Nike than the entire workforce in Indonesia are paid to make Nike products.

Is this the new global village we’re told is our future, or is this an old project, that used to be run by the divine right kings, but is now run by the divine right of corporations and the government s which back them?

This film is about the New Rulers of the World – and especially their impact on one country – Indonesia.

Indonesia –history/ background

Indonesia is where the old imperialism meets the new. This is a country which should not be poor as it is rich in natural resources such as oil and gold, copper, timber and the skills of its people.

It was first colonised by the Dutch in the 16th century, and plundered by the west for hundreds of years, a debt which is yet to paid back.

Pramoedayo Ananta Toer (ex political prisoner)

“For hundreds of years Indonesia and many other countries were sucked dry by the European countries, who became strong, and the masters of finance and commerce, and now they are dictated to by the World Bank and the IMF – Indonesia has been turned into a country of beggars because its elite is spineless.

George Monbiot (well-known environmentalist)

“We’re told that globalisation is going to bring us all together and help combat poverty but what we’ve actually seen is the opposite – the poor are becoming poorer, and the wealthy are becoming staggeringly wealthy”.

Rich and poor in Indonesia

The World Bank famously called Indonesia a ‘model pupil’, a success story of economic growth.

To illustrate this success the video now cuts to a lavish wedding between two merchant families – these are the elite who have reaped the benefits of globalisation –the freedom to earn money and let that money make more money.

However, Indonesia is also a very unequal country and only a relatively few people have benefited from this economic growth: 70 million people live in extreme poverty – and they’ve calculated that it would take one of the waiters working at the wedding 400 years to pay for such a wedding.

The lavish wedding is contrasted to an Indonesian labour camp less than 5 miles way where young people make the cheap consumer goods we consume in the west.

This is the backyard of global capitalism, the side we don’t see, the human price we pay for the cheap goods we buy. The average worker here gets £0.72 a day, the minimum wage in Indonesia, just over half a living wage (according to the government).

Dormitories are made from breeze blocks, they flood when it rains, and open sewers spread diseases which kill children.

The labour camp is set in an economic processing zone, which is basically a vast area of sweat shops.

Investigating Poor Working Conditions in Indonesia

The documentary crew posed as fashion buyers to gain access and secretly filmed in one factory, and also conducted dozens of interviews with workers in these factories.

Working conditions are claustrophobic, frenzied, the workers fatigued, and working under strip-lighting in temperatures of up to 40 degrees (the management however have air conditioned offices.

They also have horrendous working hours – which can be upped when deadlines for orders are due. The workers are typically young women and one worker is on camera saying that she once worked a 24 hour shift with no breaks. She says she is too scared to refuse or even question the working hours.

These factories are owned by Taiwanese and Korean contractors who take orders from companies such as GAP (whose products were made in the above factory where the workers are paid extremely low wages).

GAP has codes of conduct which are supposed to apply to working conditions globally, and GAP representatives do visit the factories, but the workers interviewed say they are warned by management to not tell them about forced overtime.

Dita Sari – Trade union leader

Points out that codes of conduct are meaningless in a country like Indonesia because there is high unemployment and terrible poverty, so the people are desperate enough to put up with dismal working conditions, and the government is unwilling to enforce the codes because they want Indonesia to be as attractive as possible to international companies (which means keeping labour cheap).

If you pay £8.00 for a pair of boxer shorts, then an Indonesian worker will receive approximately £0.04 pence of that.

In the previous year, the profits of gap were just short of £2 billion, and the CEO ‘earned’ £5 million, figures typical of many multinational companies.

For the sake of the documentary, they had to keep the factories anonymous, because the workers would have Victimisation from contractors and violence from anti-unionists.

Barry Coats – World Development Movement

We should aim to be better informed as consumers – when we buy something, we need to ask the company where it was produced and to give assurances that the workers are treated fairly.

The secret history of globalisation in Indonesia

In the 1960s General Suharto seized power in Indonesia secretly backed the United States and Britain.

Suharto removed from power the founder of modern Indonesia, Sukarno – a nationalist who believed in economic independence for the country. He had kept the Transnational Corporations and their agents, the World Bank, and the IMF, out of the country, but with Suharto coming to power they were called back in to ‘save’ Indonesia.

This regime change was one of the bloodiest mass murders in post WW2 history, with more than a million people estimated to have died in the process. Suharto took brutal steps to consolidate his power by rounding up thousands and thousands of civil servants, school teachers and basically anyone with communist leanings and murdering them.

He did this with the support of the CIA, who provided a list of 5000 people they wanted dead, and the British ambassador at the time suggested a little shooting was necessary to ease the transition, while British war ships played a supporting role in protecting Indonesian troops.

Within a year of Suharto’s coming to power the economy of Indonesia was effectively redesigned, giving the west access to vast natural resources, markets and cheap labour, what Nixon called ‘the greatest prize in Asia.

The American press reported these events not as a crime against humanity, but in terms of ‘The West’s best news for years’.

In 1967 – a conference in Switzerland planned the corporate take-over of Indonesia, with most of the world’s large international companies represented, such as ICI, General Motors and American Express. For western business this was the start of the gold rush which later became known as globalisation, and barely anyone mentioned the million dead Indonesians.

Professor Jeffrey Winters

Has never heard of a situation like this where global capital holds a meeting with the state and hammered out their interests. The conference lasted for three days – and the companies present hammered out policies which would be acceptable to them on a sector by sector basis. They basically designed the legal infrastructure for investment in the country.

It basically becomes clear from a series of interviews, despite their evasiveness, that the international business community new they were dealing with a nepotistic mass murderer.

Globalisation – the British arms connection

Globalisation began in the 1980s when Margaret Thatcher dismantled manufacturing and poured billions of pounds into building up the arms industry. Suharto was an important customer for the UK arms industry at that time, and sales to Indonesia were supported by ‘export credits’, in other words, a large part of Suharto’s arms bill was paid for by the British tax payer.

So important was Suharto to British arms exporters, that he was welcomed to London by the Queen.

The World Bank and the IMF – The New Rulers of the World

Who are the new rulers of the world? Their empire today is greater than the British Empire ever was. Basically they are the World Bank, and the International Monetary Fund, two bodies which are the agents of the richest countries on earth, especially America.

Initially set up to help rebuild European economies after WW2, they later they began offering loans to poor countries, but only if they privatised their economies and allowed western companies free access to their raw materials and markets.

Barry Coates

Debt has been used by an instrument by the World Bank and IMF to get their policies implemented. The poorest countries are in a cycle of poverty, and current debt-reduction (not forgiveness) is not sufficient to allow them.

Susan George

The difference between Tanzania and Goldman Sachs

Tanzania – is a country with a GDP of $2.2 billion shared among 25 million, Goldman Sachs is an investment bank with profits $2.2 billion dollars shared among 162 partners.

The World Bank says its aim is to help poor people, calling this gobal development. It’s an ingenious system, a sort of socialism for the rich and capitalism for the poor – the rich get richer on running up debt, cheap labour and paying as little tax as possible, while the poor get poorer as their jobs and public services are cut to pay just the interest on the debt owed to the World Bank.

Here in Indonesia, the hand-outs to the rich have been extra-ordinary, internal documents from the World Bank confirm that up to a third of the banks loans went into – around $8 billion.

The 1998 Financial Crash, the End of Suharto and Indonesian Debt Repayment

Globalisation means that capital (big money) can be moved anywhere at any time, without warning.

In 1998 short-term capital was suddenly pulled out of Asia, collapsing the miracle economy overnight. This actually benefitted Nike in Indonesia, because they ended up labour costs were cut to 25% of what they had been previously.

With the economy collapsed, and Indonesia on the verge of revolution, Suharto was forced to step down, having already stolen an estimated $15 billion.

During his reign of more than 30 years, Suharto had handed out public utilities to his family and cronies, driving from Jakarta airport, you actually paid a toll to Suharto’s daughter.

Interview

The bank presents itself as an economic development agency, focusing on poverty reduction, but in fact, the bank operated during the entire cold war as an institution which distributed money to mainly authoritarian regimes in the third world that supported the West in the Cold War.

The Indonesian elite instigated many development projects with World Bank loans during Suharto’s 30 year reign, and many of them were seen as opportunities to skim money for themselves. In total, $10 billion remained unaccounted for out of $30 in loans. Of course the debt remained, and still had to be paid back to the World Bank.

According to the auditor general of the World Bank, if the citizens of Indonesia made a legal challenge against the World Bank over the remaining debt (given that they never received the money), the World Bank would be bankrupt, because this has gone on the world over.

Interview with Chief Economist of the World Bank – Nicholas Stone

In response to the question of how the World Bank didn’t realise that $10 billion of aid money to Indonesia had gone missing, his response was firstly to deny any knowledge of the $10 billion figure, then (on having been shown the World Bank’s own report) to say that figure was made up. He finally argued that progress had been made during Suharto’s regime if we look at literacy and infant mortality figures, even if the numbers in poverty had doubled from 30 million to 60 million.

When asked why there was such a silence over the atrocities of Suharto, he simply said the World Bank got it wrong, and they will get it wrong in the future too.

Dita Sari

Globalisation creates debts, creates misery, creates crisis, and creates privatisation, which pushes up the prices people have to pay for basic goods. In effect the money stolen by the Suharto regime is being paid back by the people who never benefited from that money.

Debt and the International Monetary Fund (IMF)

Every day nearly $100 million is transferred in debt repayments from the poorest countries to the richest, it is a debt that can never be paid back, given that half the world’s population live on less than $2 a day.

Interview with Stanley Fischer, from the International Monetary Fund

John Pliger asks whether debt cancellation should be a priority if we are to alleviate poverty, given that some countries spend half their GDP on debt repayments.

Fischer argues that we should not necessarily cancel their debt – we should rather look at the policies on education and health, and look at what sort of economies they run – do they integrate into the world economy, or do they run corrupt economies.

Fischer basically argues that countries need to repay their debts because they need to keep more resources flowing into their countries, and if they don’t repay them, they’ll never be leant to again. He sees debt as a ‘normal’ part of expanding enterprise and increasing economic growth.

NB – The subtext to the interview is that Western financial institutions depend on the debt repayments being kept up too.

Dita Sari

(In order to keep up debt-repayments) the government, as recommended by the IMF. has cut subsidies on electricity, water and education, which means that the workers have to pay more their children through school.

Now people now eat two meals rather than three meals a day.

Protests at the World Trade Organisation

Two years ago, protestors from all over the world converged on Seattle at a meeting of the World Trade Organisation….

Evaluation – How Valid are the Findings of this Documentary Today?

The documentary makes the following claims, all of which are worth investigating to see if they are still true today….

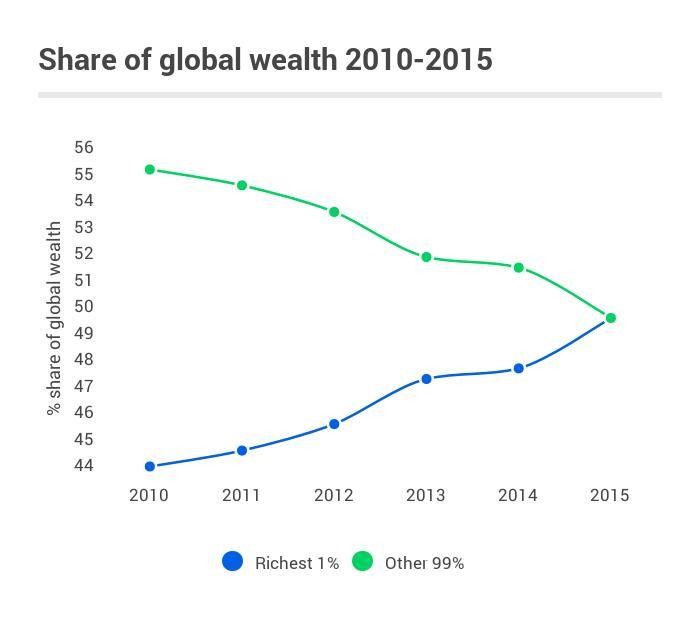

- The rich are getting richer and the poor are getting poorer

- 200 Corporations control 25% of world economic activity

- The World Bank and the IMF dictate economic policy to poor countries

- These economic policies are shaped by the 200 (or so) largest global corporations and work in their interests, not in the interests of the majority of people in poor countries.

- There is a small elite in poor countries which benefit from these economic policies and enforce them, against the interests of the majority.

I’ll provide a summary of the rest at a later date… In the meantime, you might like to actually watch the rest of it!

Related Sources

The New Rulers of the World – video on John Pliger’s website

The New Rulers of the World – the book!

A brief summary of part of Arundhati Roy’s ‘Capitalism: A Ghost Story’ – In which she explores some of the consequences of privatisation (part of neoliberalisation) in India.

A brief summary of part of Arundhati Roy’s ‘Capitalism: A Ghost Story’ – In which she explores some of the consequences of privatisation (part of neoliberalisation) in India.